Note that in both cases the multiplier is limited to 75% by lawĭetermined medically unfit for continued service with a DoD disability rating of at least 30%

Eligibility to elect the Career Status Bonus ended as of December 31, 2017īlended defined benefit and defined contribution plan.Īll covered members receive a Government contribution that equals 1% of basic or inactive duty pay to a tax-advantaged retirement account (Thrift Savings Plan (TSP)) after 60 days following the entry into Uniformed Service. Optional retirement plan for active duty members with an initial date of entry into service after July 31, 1986, but before January 1, 2018. Primary retirement plan for members with initial date of entry into service on or after September 8, 1980, but before January 1, 2018Ĭareer Status Bonus $30,000 lump sum payment at 15th year of service with obligation to serve through 20 years + defined benefitĢ.5% times the number of years of service minus 1.0% for each year of service less than 30, times the average of the member’s highest 36 months of basic payĢ.5% times the number of years of service times the average of the member’s highest 36 months of basic pay

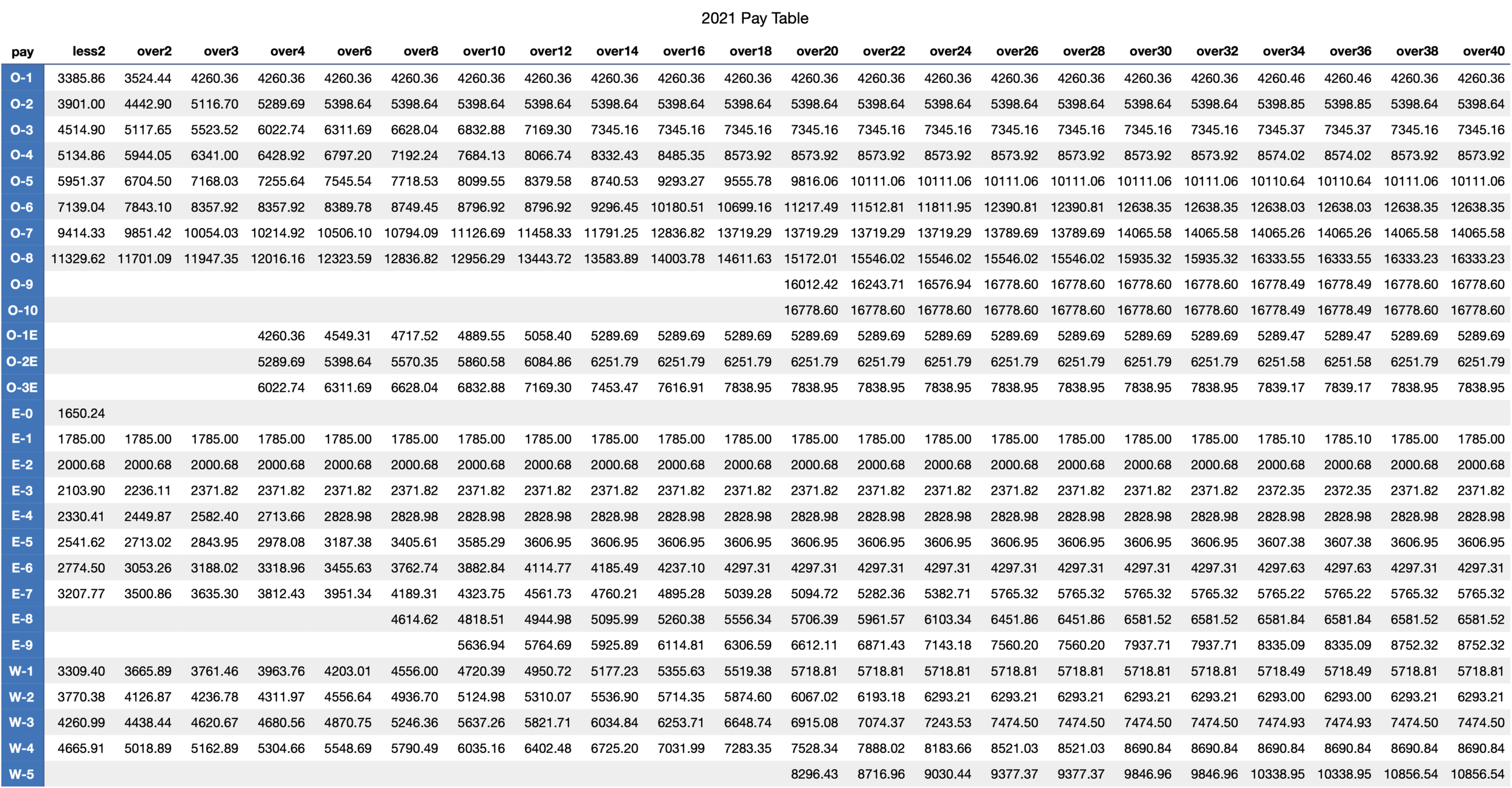

Primary retirement plan for Reserve members with initial date of entry into service prior to September 8, 1980ĭefined Benefit that equals 2.5% times the number of years of service times the average of the member’s highest 36 months of basic pay Name of Retirement Planĭefined Benefit that equals 2.5% times the number of years of service times the member’s final basic pay on the day of retirement The following chart summarizes the differences between the four regular and non-regular retirement plans and disability retirement.

0 kommentar(er)

0 kommentar(er)